New vehicle sales volumes robust

03 April 2023: Indebted motorists were faced with a 0.5% increase in interest rates in March, increasing their instalments on those finance contracts linked to prime. The increase was the second this year, raising interest rates to their highest level since 2009 and placing continued pressure on household budgets and vehicle affordability.

Although fewer than a year ago, the vast majority of WesBank vehicle finance contracts are linked to the prime rate. “In addition to making existing linked finance agreements more expensive, the higher-than-expected interest rate hike will no doubt challenge affordability and future purchase decisions for the new vehicle market, which could begin impacting sales volumes over the coming months,” says Lebogang Gaoaketse, Head of Marketing and Communications at WesBank.

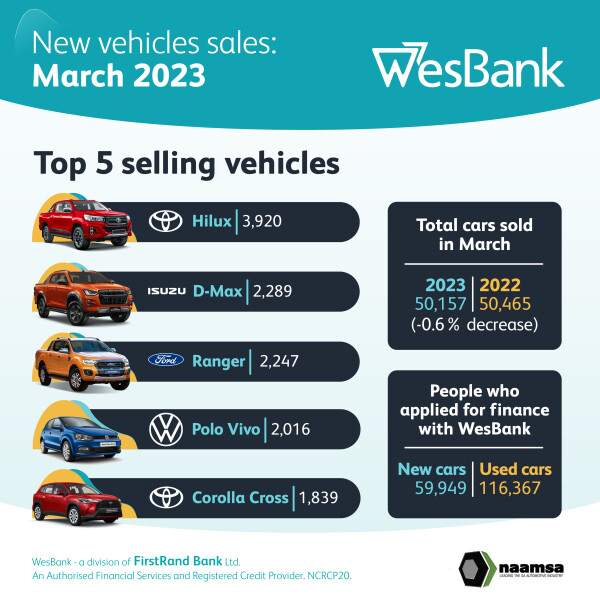

March sales a year ago were a record-breaking month when the market broke through the 50,000-unit barrier, providing lots for the industry to celebrate at the time. A year later, the market returned to the milestone, selling 50,157 units, albeit 0.6% down year-on-year.

“Despite the public holidays, March is a long sales month and this month’s performance mirrored what was the best-selling month last year,” says Gaoaketse. “Both March 2022 and 2023 have been the only sales months to breach the 50,000-unit level since October 2019.”

March volumes were significantly bigger than February (45,198 units) indicating that growth remains possible despite the headwinds of the continued energy crisis, rising interest rates, and the pressures of inflation on household budgets.

According to figures released by naamsa | the Automotive Business Council, passenger car sales declined 6.4% to 31,631 compared to March last year. Dealer sales in the segment were less-affected, 27,172 cars being registered off the showroom floor, down 3.9% year-on-year.

Light Commercial Vehicle sales remained strong, up 11.1% to 15,529 units, also reflected in the dealer channel volumes, up 11.7%. This segment continues to be boosted by recent new model introductions.

Year-to-date sales are up 2.4%, closing out the first quarter on 139,437 units. “WesBank continues to expect market growth this year off the back of improved supply and the need to refresh the replacement cycle that has been delayed over the past few years,” concludes Gaoaketse.

YouTube video link:

-ENDS-